The Isle of Man’s housing market continues to draw interest from UK buyers despite wider market caution

There’s unwelcome news for homebuyers as average mortgage costs in the UK have risen for the first time since February.

According to Moneyfacts, rates have edged up slightly after several months of steady reductions.

Further cuts to the Bank of England’s base rate are also seen as unlikely before the upcoming UK Budget.

The Isle of Man’s property market, meanwhile, remains active, with growing interest from potential buyers in the UK.

Moneyfacts report that the latest situation may disappoint borrowers.

They say volatile swap rates and a cautionary approach from lenders have led to an abrupt halt in consecutive monthly average rate falls.

The general view among analysts is that a sustained period of rising mortgage rates is unlikely.

Simon Gammon, managing partner in UK based mortgage advisors Knight Frank Finance told the BBC the market is more likely to experience a prolonged plateau until the outlook becomes clearer.

Treasury reviewing measures announced in UK Autumn Statement

Treasury reviewing measures announced in UK Autumn Statement

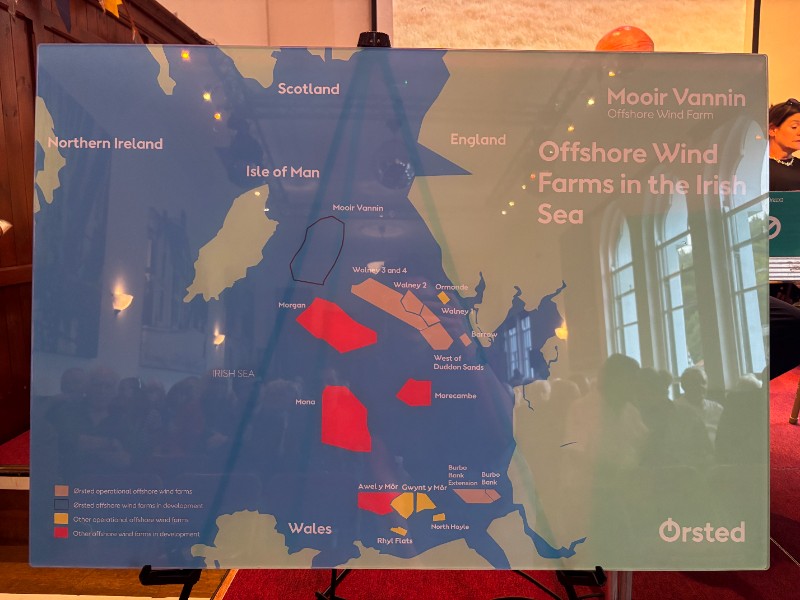

Two local authorities submit objections to Ørsted's offshore windfarm proposals

Two local authorities submit objections to Ørsted's offshore windfarm proposals

Two thirds of juvenile offences in 2024/25 committed by 18 young people

Two thirds of juvenile offences in 2024/25 committed by 18 young people

Government 'must seriously consider' MoD wind farm objection, says MHK

Government 'must seriously consider' MoD wind farm objection, says MHK