Bank team updates KYC best practice

Twenty-four Manx bank staff have a new string on their bows after completing an en masse training programme in managing risk and compliance.

The International Compliance Association advanced certificate in customer due diligence takes six months to complete - and gives candidates the know-how to keep up with modern-day KYC practice.

NatWest staff, who undertook the course as part of a company enrichment scheme, underwent training exercises and examinations to earn the qualification.

But hard work paid-off, as all the staff, along with another 23 from elsewhere in the Channel Islands, achieved a 100% pass rate.

NatWest's Head of Services Tracy Burns said it's an integral step in the bank's commitment to anti-money laundering and 'keeping customers safe and secure'.

Chief minister insists progress is being made on affordable housing targets

Chief minister insists progress is being made on affordable housing targets

Government reaffirms support for Isle of Man apprenticeships

Government reaffirms support for Isle of Man apprenticeships

Construction sector calls for full review of apprenticeship funding

Construction sector calls for full review of apprenticeship funding

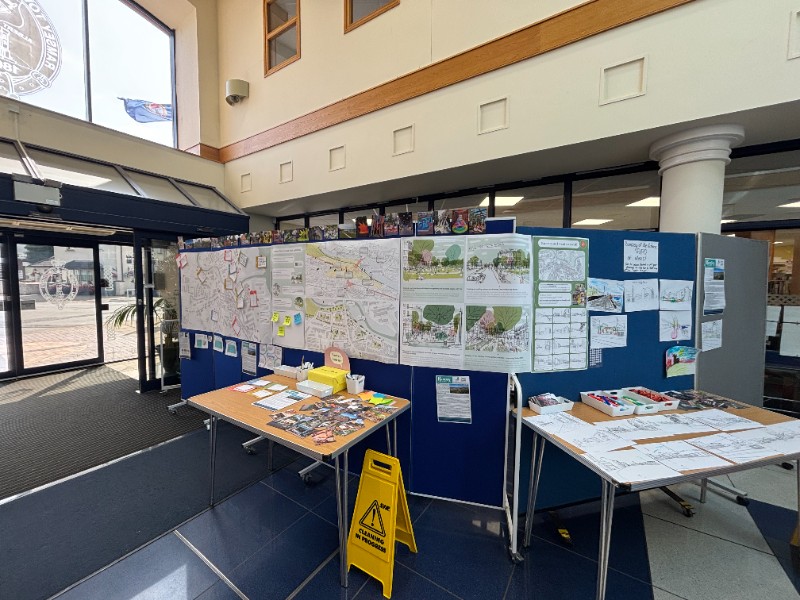

Northern Chamber of Commerce hopes 'masterplan' will encourage investment in Ramsey

Northern Chamber of Commerce hopes 'masterplan' will encourage investment in Ramsey