Grant Thornton issues guidance to valuators

There's much encouragement for start-up enterprises in the Isle of Man - this year's IsleExpo and the re-styled Department for Enterprise have made fostering entrepreneurship a priority.

But getting the valuation of a start-up enterprise right can be problematic. According to accounting and audit company Grant Thornton it is a complex combination of science and art.

The firm's analysed the motivations and expectations of start-ups and investors, and issued guidance on how to achieve a balance.

Isle of Man director Martin Kneale says the traditional valuation model based on predicted future cash flow discounted by the inherent risk facing the business, is a starting point only.

Mr Kneale says key variables - from the entrepreneur's ability to implement an idea to successful use of new technology - make valuations 'very challenging'.

He says start-up valuators must understand the company's key assets are likely to be intangibles.

Grant Thornton's advice is discursive rather than a bullet-point check list.

It suggests an 'artistic' approach should be applied, where investor as buyer, and entrepreneur as seller, evaluate the business using both qualitative information and subjective judgement.

Treasury 'content' with Steam Packet oversight arrangements

Treasury 'content' with Steam Packet oversight arrangements

Government publishes updated insurance sector money laundering risk assessment

Government publishes updated insurance sector money laundering risk assessment

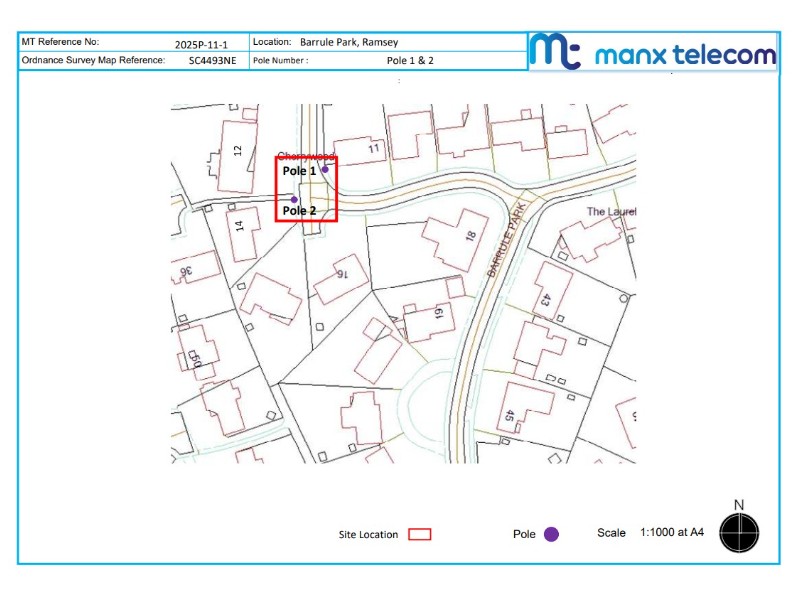

Application for fibre poles in Ramsey estate refused

Application for fibre poles in Ramsey estate refused

CoMin 'recognises and is mindful' of minimum wage concerns

CoMin 'recognises and is mindful' of minimum wage concerns